當僱員停止受僱,作為僱主,須在僱員停止受僱前 1 個月,填交1份 IR56F 表格 (或經僱主電子報稅填報IR56F)。填寫該表格的時候,除了基本信息外,要注意以下內容:

- 停止受僱的原因(辭職、退休、解僱、身故等);

- 停止受僱的日期和由4月1日起至離職當日的詳細入息(不包括根據《僱傭條例》所應支付給僱員的遣散費和長期服務金,只需填報超出的款額);

- 包括僱員稍後由計劃中收取或視作已收取並屬於僱主的自願性供款的款額。

例:

Tim將於2020年7月31日從公司離職,但是不會離開香港,此時作為僱主:

- 需要在6月31日或以前交回一份填妥的IR56F表格(或經僱主電子報稅);

- 公司須將已填交的IR56F表格副本交給Tim作為參考。

注意⚠️:如果公司已經為Tim填交了IR56F表格,就不需要再次為他填交該年度的IR56B表格,因為就相同收入填交兩份不同的IR56系列表格,可能會導致同一筆收入重複計稅。

請參閱IR56F表格範本

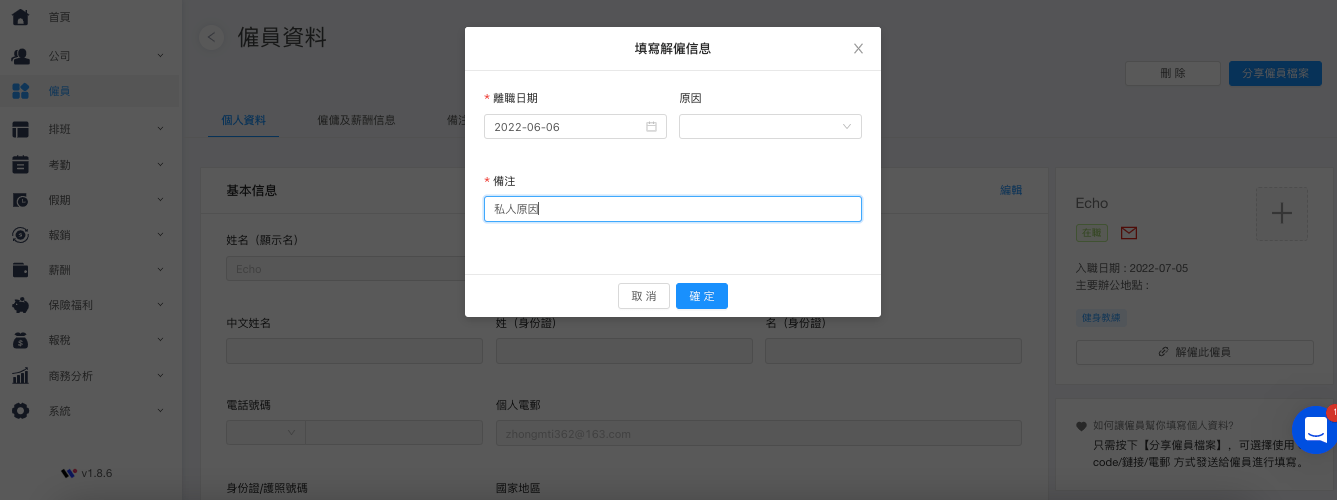

若僱員離職,沒有記錄到正確的離職時間、日期及原因是會對表格的填寫帶來極大的不方便。因為作為HR,需要再次詢問離職僱員,一來一回,時間全沒。

所以,HR系統 — Workstem可以幫你解決這個麻煩。 當僱員離職時,選擇日期連同填寫原因,即可用Workstem報稅系統導出IR56F報表,無須再逐個手入資料!

延伸閱讀:《僱員離港,需要給稅局遞交什麼表格?》