When an employee ceases to be employed, an employer has to file one copy of IR56F or via Electronic Filing of Employer’s Return one month before the date of termination of his employment. In addition to the basic information, pay attention to the following particulars:

- Reason for cessation (e.g. resignation, retirement, dismaillsal, death, etc.)

- Date of cessation and details of income from 1 April to the date of cessation of employment (not include the severance payment/long service payment made under Employment Ordinance, only report the excess amount made)

- Includes any payment subsequently received or is taken to have been received from the scheme(s) in respect of voluntary contribution by employer

For example:

Tim will leave the company on July 31, 2020, but will not leave Hong Kong. A completed form IR56F is required to be returned on or before June 31 (or via Electronic Filing of Employer’s Return). The company should provide a copy of the completed IR56F form to Tim for reference.

Note: if the company has already filled in form IR56F for Tim, there is no need to file form IR56B in the following Annual Reporting of Employees’ Income for him for that year, so as to avoid double counting.

Please refer to IR56F

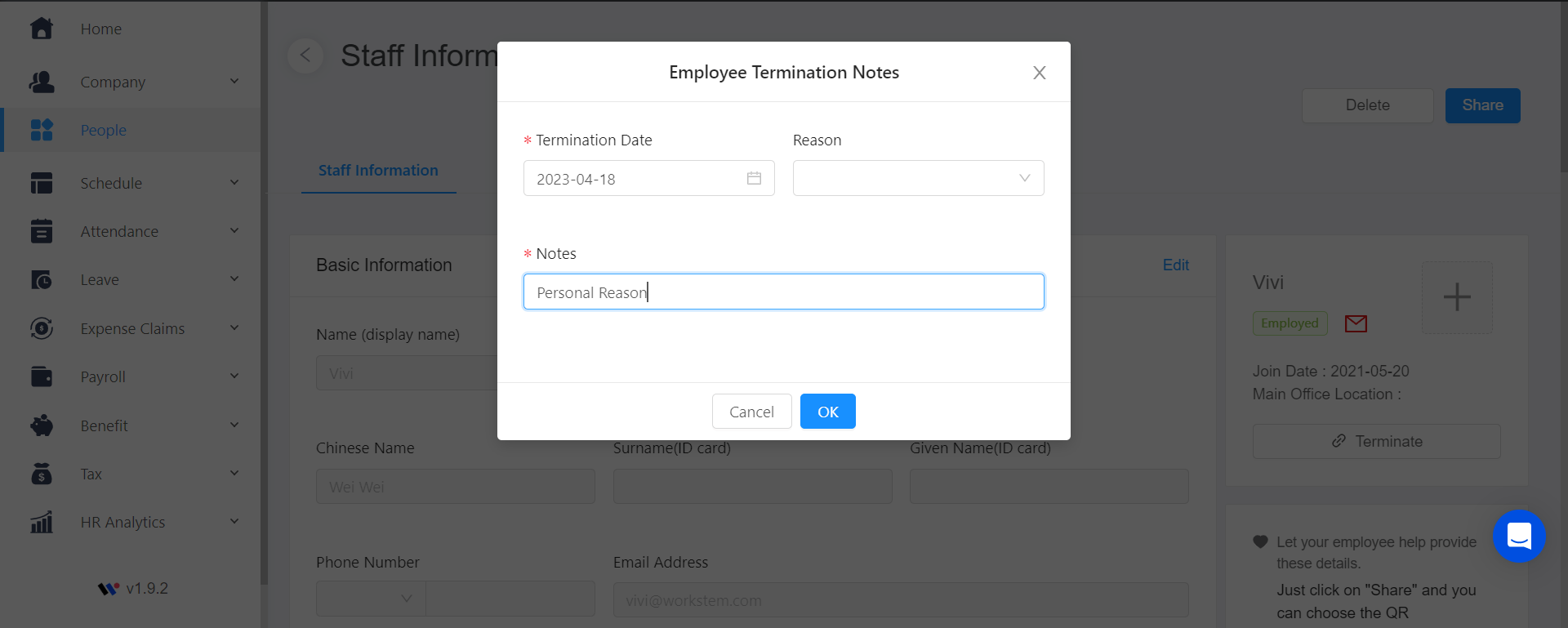

If an employee ceases to be employed, it will be very inconvenient to file the form if he fails to record the correct time, date, and reason. As HR, it is very time-consuming to ask them again.

Therefore, the HRM system——Worsktem can help you solve this problem. When an employee resigns, select the date and fill in the reason, and IR56F can be exported in one click, and there is no need to manually enter the data one by one!

Read More: Which Form to Submit to IRD when an Employee Leaves Hong Kong?