I believe that every company will include a probation period for new employees, typically three months in length, but also have six months in length. Do employers need to make contributions for employees during their probation period? Is it necessary to deduct the MPF amount when paying the salary for them?

Both regular employees and casual employees need to make contributions. Employers in all industries should enrol their regular employees who have been employed for a continuous period of 60 days or more in an MPF scheme within the first 60 days of employment.

Therefore, employers should enrol the employees who are in the probation period in an MPF scheme within the first 60 days of employment without considering their performance.

For regular employees on a probation period, the employer is required to make their part of the mandatory contribution from the first day of the employment period. However, the employee can enjoy a contribution holiday and is not required to make the mandatory contribution on their part for the first 30 days of the employment and the first incomplete payroll period.

Of course, it’s not so lucky for employers that every new employee joins the company at the beginning of the month (the full pay period is from the 1st to 30th / 31st of the month), and most of them are in an incomplete payroll period.

Note: It is an offence for employers to fail to enrol their employees in an MPF scheme by the deadline. Upon conviction, an offender is liable to a maximum penalty of a fine of HK$350,000 and imprisonment for 3 years.

Example

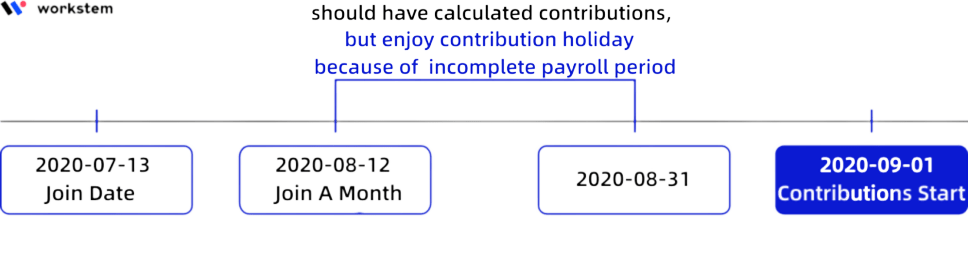

A regular employee starts a job on 13 July 2020. 12 August is the first 30 days of employment. Since 12 August to 31 August is an incomplete wage period, employees need to make contributions in September.

13 July to 31 August is an incomplete payroll period, the employer should not deduct the employee’s contribution from the relevant income.

Note: If an employer without reasonable excuse deducts the employee’s contribution from the employee’s relevant income during the employee’s contribution holiday, the employer is liable on the first conviction to a penalty of a fine of HK$100,000 and to imprisonment for 6 months, and to a penalty of a fine of HK$200,000 and to imprisonment for 12 months on each subsequent conviction.

Remember that employers do not have a contribution holiday, and it will make you feel a headache to count the contribution holidays one by one on a calendar. Maybe it’s very easy to do it for one employee, but what about 20? Let the HRM system help you calculate! The MPF function of Workstem can automatically calculate the contribution day just by entering the employee’s join date. It is going to help you throughout the entire payroll process!

Read More:

Should Part-time Employees Also Enroll in the MPF Scheme?

The Most Used Hong Kong MPF Calculation Formula

How to Calculate the Amount of MPF Contributions for Non-monthly-paid Employees?

![[418 Guide] Ordinance 418 And Continuous Contract](https://www.workstem.com/wp-content/uploads/2023/08/Untitled-design-min-350x220.png)