When a Hong Kong company employs an employee, the employer has various taxation obligations, in particular the completion of Hong Kong employer’s tax forms. Employers are often overwhelmed by the number of names on their taxes. So today we’re going to talk about the form IR56F that employers should complete when an employee leaves.

What is Form IR56F?

Form IR56F is also known as “Notification by an employer of an employee who is about to cease to be employed”. It applies to any employee who is about to leave his/her job. Hong Kong employers are required to submit this form to the Inland Revenue Department one month before date of cessation.

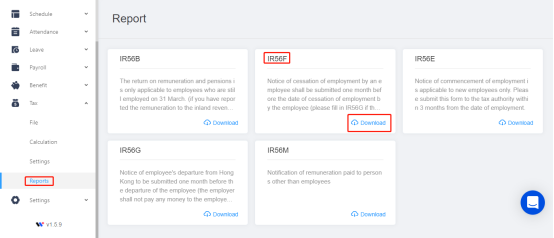

Source: Inland Revenue Department

What should employers do before the employee is about to leave?

Employers are required to submit form IR56F “Notification by an employer of an employee who is about to cease to be employed” to the Inland Revenue Department one month before date of cessation.

Note for employer upon cessation of employment (or death)

- Employers should complete a form IR56F (or submit an form IR56F via the employer’s eTax) one month before date of cessation.

- From the date of filling in the form, employers are not allowed to make any payment to the employee until the employee completes the tax clearance process and produces the “release consent” issued by the Inland Revenue Department.

- It should be noted that if the company has already completed the form IR56F for the employee, it is not necessary to complete the form IR56B for the same year again as the completion of two different IR56 series forms for the same salary may result in double tax.

Example: Mr. Davon Lau resigned from Company A on July 5th, 2021.

- Company A should inquire and confirm whether Mr. Lau will leave Hong Kong after his resignation.

(a) If he will not leave Hong Kong, Company A should complete a copy (form IR56F /via the employer’s eTax) on or before June 5th, 2021.

(b) If he will leave Hong Kong, Company A should complete two copies (form IR56G /via the employer’s eTax) and not make any payment to Mr. Lau.

- Company A should submit a copy of the completed form IR56F to Mr. Lau for reference.

- It should be noted that if Company A has already completed the IR56F for Mr. Lau, it is not necessary to file the IR56B for the same year again as the completion of two different IR56 series forms for the same salary may result in double tax.

How to turn the traditional tax form completion into a simple eTax?

After receiving the tax forms, a small number of employers will continue to choose to either visit or post the notice of cessation of employment for their employees, i.e. the form IR56F. But more people will complete their tax forms online through the simple and efficient eTax. Facing the complicated tax forms, employers and HR will inevitably have a headache. Is there a penalty for late completion? How to complete the tax forms?

There is nothing to worry about! Workstem not only provides download of form IR56F in different formats, but also performs tax calculation (data is derived from pay run) to help you complete your taxes simply and efficiently.

Read More:

What You Need to Know about IR56F / IR56G

Which Form to Submit to IRD When an Employee Who is About to Cease to Be Employed?

(The content and information in this article are for reference only. The accuracy and reliability of the information are subject to the latest government regulations. If you want to reprint the article or content, please contact us first or attach a link to this article, and indicate the source of reprint.)

![[418 Guide] Ordinance 418 And Continuous Contract](https://www.workstem.com/wp-content/uploads/2023/08/Untitled-design-min-350x220.png)