When making MPF contributions, “relevant income” is always mentioned. The most common one is the relevant income x 5% amount of mandatory contributions payable by the employer. Does the relevant income represent the salary paid by the employer?

The definition from Mandatory Provident Fund Schemes Authority refers to all monetary payments paid or payable by an employer to an employee, including wages, salary, leave pay, fees, commissions, bonuses, gratuities, perquisites or allowances, but excluding severance payments or long service payments under the Employment Ordinance (Chapter 57, Laws of Hong Kong).

In other words, the salary, bonus, holiday allowance, housing allowance, and other common pay items received by an employee can also be counted as relevant income. However, if the company layoffs and pays the employee severance payment, or the long service payment received by the employee after leaving the company under certain conditions, these two pay items are not included in the relevant income. In addition, marriage allowance and bonuses for passing professional examinations are not included in the relevant income either.

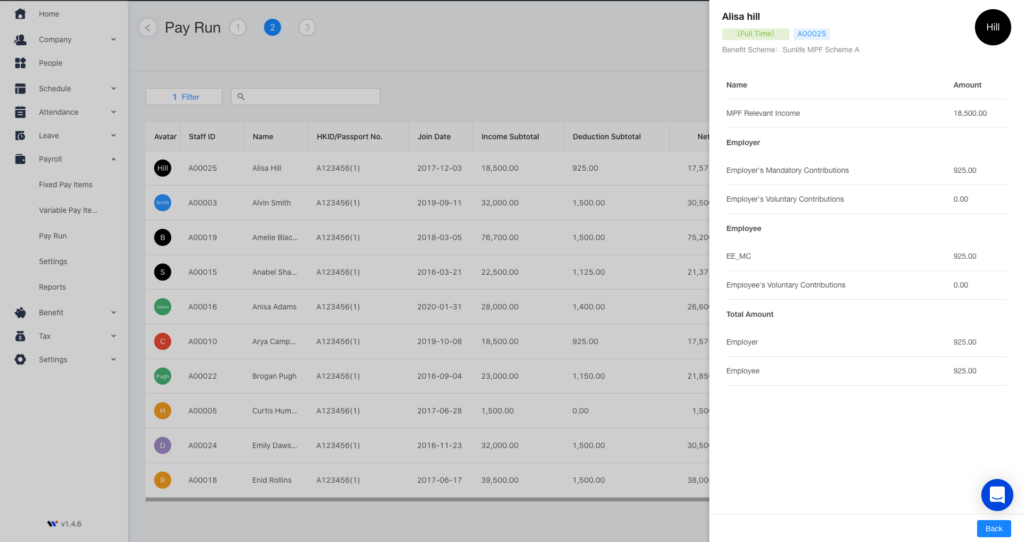

It is necessary to know the income additions and deductions when paying the employees. For example, salary, allowance, commission, etc. are included in the net pay. But if an employee applies for no pay leave or sick leave for more than 4 consecutive days in the current month, it should be included in the deduction.

The MPF calculation function of Workstem can automatically determine and calculate the minimum and maximum contribution amount according to the relevant income of employees. Once income additions and deductions have been set up, you don’t need to worry about the mistakes anymore!

Read More:

Who is Required to Join an MPF Scheme?

Non-“418”-rule Employees No Need to Enrol MPF Scheme?

(The content and information in this article are for reference only. The accuracy and reliability of the information are subject to the latest government regulations. If you want to reprint the article or content, please contact us first or attach a link to this article, and indicate the source of reprint.)

![[418 Guide] Ordinance 418 And Continuous Contract](https://www.workstem.com/wp-content/uploads/2023/08/Untitled-design-min-350x220.png)