Most of staffs know types of MPF schemes and how to join an MPF scheme and I believed that many of you have already had a basic knowledge about it. But there are people still confusing about the following questions:

When is my contribution period?

Why do some companies ask employees to complete the form while others ask after a few months?

What is contribution holiday?

Over 80% of employees join the MPF schemes, so HR must be aware of the details of the contribution to protect the rights of employers and employees. There are three types of MPF scheme:

- Master Trust Schemes

- Industry Schemes

- Employer-sponsored Schemes

Master Trust Schemes is the most common type of MPF scheme, except for some special circumstance, for example, employer does not need to arrange an MPF scheme for an employee who just joins the company or employee who is employed less than 60 days. Employee enjoys contribution holiday while employer has not, therefore, the employer’s mandatory contributions shall be payable from the first day of employment.

Enrolment and contribution

Enrolment

According to legislation, employers in all industries should enrol their regular employees (i.e. employees who are at least 18 but under 65 years of age and have been employed for a continuous period of 60 days or more) in an MPF scheme within the first 60 days of employment. Full-time, part-time, self-employed even temporary employees (except for exempt persons) are all covered by the MPF scheme that select by the employer. For example, if an employee employed on 14 August, employer should enrol him/her in an MPF scheme, otherwise, the employer would violate the law.

Contributions

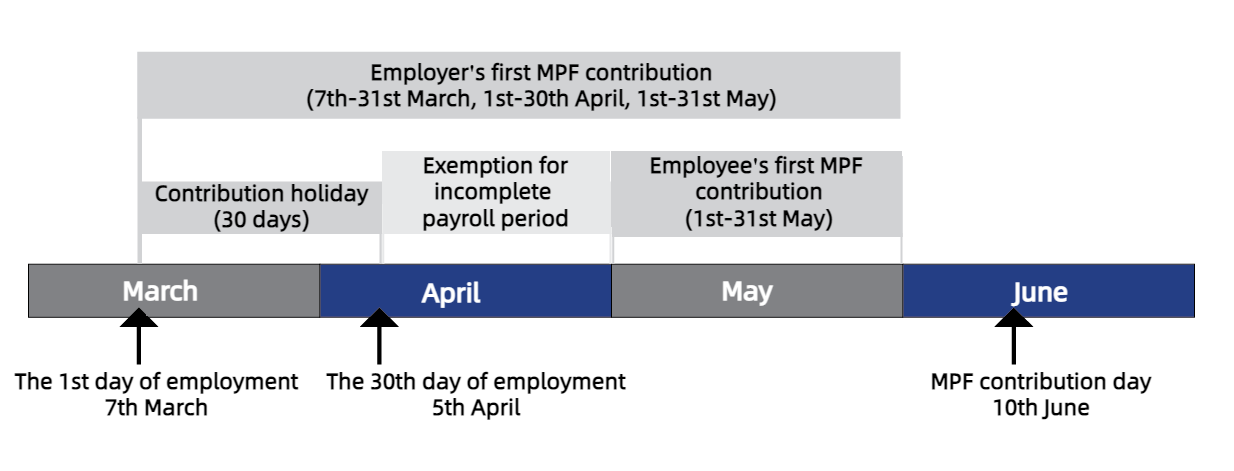

Technically, the first contributions should be paid to your employee on or before the 10th day after the last day of the calendar month on which the 60th day of employment falls.

- For example, your employee was employed on 7 June, so his/her first day of employment is 7 June. Since his/her 60th day of employment falls on 5 August, you should make first-time contributions for him/her, on or before the 10th day of the month following August, i.e. 10th September.

- If his/her 60th day of employment falls on 20th August, you should make first-time contributions for him/her, on or before the 10th day of the month following August, i.e. 10th September.

- If the contribution day falls on a Saturday, a public holiday, a gale warning day or a black rainstorm warning day, the contribution day is extended to the next following day which is not a Saturday, a public holiday, a gale warning day or a black rainstorm warning day.

There are many retail enterprises make contributions for new employees no matter they are full-time or part-time to save administrative costs because of a large number of employees and a big fluctuation in employee headcount.

What is contribution holiday?

Contribution holiday means your new employees are not required to make contributions for the first 30 days of employment and any incomplete payroll period that immediately follows the 30-day period (if the employee’s wage period is monthly or shorter than monthly). But, as an employer, you should make contributions for your employees from the first day of their employment.

Complete payroll period means the calendar month in which the 30th day of employment falls. For example, an employee’s first day of employment is the first day of the month, then at the end of the month, i.e. 30 or 31, can be regarded as a complete payroll day. As long as the employment is continuous, no matter how many days employee works, you should make contributions for them.

When should I make contributions for new employees?

Take an employee named Mike as an example. Mike is a non-industry-scheme employee signed a long-term contract with a company. His salary is HK$9,500, calculated as an incomplete payroll period. After 60 days of employment, the company should make contributions for Mike, and the amounts of both employer’s and Mike’s contributions are listed as follows.

Case A

Mike’s first day of employment is 7 March. Since his 30th day of employment falls on 5 April, and the left 25 day is an incomplete payroll period, the contribution holiday is from 7 March to 31 April. Mike does not need to make any contribution.

| March (3.7~3.31) | April (4.1~4.30) | May (5.1~5.31) | |

| Mike | HK$0 | HK$0 | HK$475 (First-time contribution) |

| Employer | HK$383.1* | HK$475 | HK$475 |

(*The salary in March is HK$7,662)

Case B

Mike’s first day of employment is 1 April. Therefore, a complete payroll period is in May, and the contribution holiday is in April. Mike begins to make a contribution in May.

| April (4.1~4.30 | May (5.1~5.31) | |

| Mike | HK$0 | HK$475 (First-time contribution) |

| Employer | HK$475 | HK$475 |

Case C

Mike’s first day of employment is 1 January, which is within 30 days in the first month. February is regarded as a complete payroll period, so the contribution holiday is January.

| January (1.1~1.31) | February (2.1~2.28) | March (3.1~3.31) | |

| Mike | HK$0 | HK$475 (First-time contribution) | HK$475 |

| Employer | HK$475 | HK$475 | HK$475 |

Case D

Although Mike’s first day of employment is 2 January, it is still within 30 days calculated from 2 Jan to 31 Jan. Therefore, February is a complete payroll period and January is contribution holiday.

| January (1.2~1.31) | February (2.1~2.28) | March (3.1~3.31) | |

| Mike | HK$0 | HK$475 (First-time contribution) | HK$475 |

| Employer | HK$475 | HK$475 | HK$475 |

Case E (Dismissal)

Mike’s first day of employment is 1 March, his 60th day of employment falls on 29 April. He resigns on 28 April, therefore, neither employee nor employer should make any contribution.

Case F (Dismissal)

Mike’s first day of employment is 1 January, his 60th day of employment falls on 1 March (not leap year), and his last working day is 28 February. Although he has worked for two complete payroll periods, the period of employment is less than 60 days, neither employee nor employer should make any contribution.

Special situation

Exempt persons

The following are exempt persons who are not required to join an MPF scheme:

- domestic employees;

- self-employed hawkers;

- people covered by statutory pension or provident fund schemes, such as civil servants and subsidized or grant school teachers;

- members of occupational retirement schemes which are granted MPF exemption certificates;

- people from overseas who enter Hong Kong for employment for not more than 13 months, or who are covered by overseas retirement schemes; and

- employees of the European Union Office of the European Commission in Hong Kong.

Industry schemes

There is no contribution holiday for the only construction industry and catering industry, because of the high labour mobility of “casual employees” occurs in these two industries. As a matter of fact, some companies would select Industry Schemes for them. Most part-time and casual employees would open MPF accounts related to their MPF schemes, while employers make contributions according to the calculation of their working days/hours. Though employees work for one day, employers should make contributions for them as well.

For companies in these two industries, employers may opt for Master Trust Schemes. Casual employees do not have contribution holiday, but employers should still make contributions for them.

MPF scheme is also available in probation period

Except for exempt persons, employees (full-time, part-time, summer interns or casual) and self-employed persons who are at least 18 but under 65 years of age and have been employed for a continuous period of 60 days or more are required to join an MPF scheme.

Workstem, an Asian lead one-stop human resources management system, helps you easily calculate your employees’ MPF income, quickly register for your employees’ MPF plans, and allows you to experience intelligent office management. Come and have a free trail!

(The content and information in this article are for reference only. The accuracy and reliability of the information are subject to the latest government regulations. If you want to reprint the article or content, please contact us first or attach a link to this article, and indicate the source of reprint.)

![[418 Guide] Ordinance 418 And Continuous Contract](https://www.workstem.com/wp-content/uploads/2023/08/Untitled-design-min-350x220.png)