相信每間公司對新人會設定試用期,一般而言是3個月,但是有些公司長至6個月。那在僱員試用期間,僱主是否需要為他們做作出供款?為他們出糧時,是否亦需要扣除強積金?

需要供款的僱員分為一般僱員和臨時僱員。就一般僱員而言,無論是全職、兼職還是暑期工,只要連續受僱滿60日或以上,僱主就需要為他們登記MPF。所以,就算是試用期內的新員工,無論表現如何,僱主亦需要在他們受僱的首60日內登記強積金並作出供款。

對於試用期的一般僱員,僱主需要從僱用期的首日開始作出僱主部分的強制性供款,但僱員是享有免供款期,無須在僱用期首30日和首個不完整的工資期作出僱員部分的強制性供款。當然不會那麼幸運地每一位僱員入職時間都在月頭(完整工資期是月內 1 號至 30/31 號),多數情況都是在一個不完整的工資期。

⚠️ 如果僱主沒有準時為僱員登記參加強積金,可以被檢控;一經定罪,最高罰款HK$350,000及監禁3年。

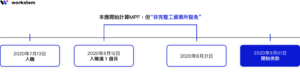

舉例來說,如果一位一般僱員於2020年7月13日入職,8月12日則是受僱的首30日,由於8月12日至8月31日並非完整工資期,所以僱員需要在9月開始供款。7月13日至8月31日則是免供款期。僱主不可以在僱員的免供款期內的有關入息中扣除僱員供款,若首次違規,罰款HK$100,000及監禁6個月;其後再犯,每次最高罰款HK$200,000及監禁12個月。

當然,僱主是不享有免供款期的。對於HR而言,去對著日曆逐個數免供款期是會眼冒金星的。1個新僱員還容易,那20個怎麼辦?人力資源管理系統來幫你計算!Workstem的MPF功能模組,輸入僱員的入職日,即可幫你自動計算免供款期。計糧至出糧的過程,全部搞掂!

延伸閱讀: